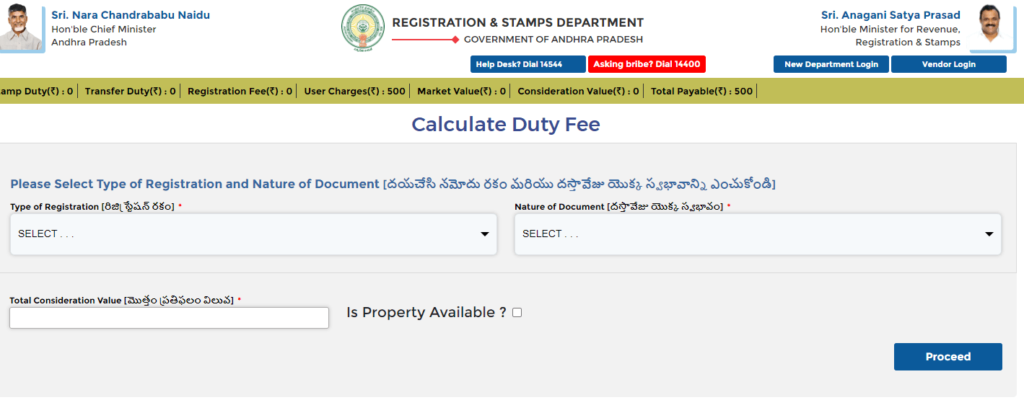

The Stamp Duty Registration charges Fee Calculator for AP IGRS (Andhra Pradesh Integrated Grievance Redressal System) is a tool provided to calculate the fees associated with property registration in Andhra Pradesh. It simplifies the process of estimating the costs, ensuring transparency and accuracy.

Input Fields

The calculator has the following fields:

Property Value (₹): Enter the total value of the property.Stamp Duty Rate (%): Default is 5%. Change it if the rate is different.Transfer Duty Rate (%): Default is 1.5%. Update if needed.Registration Fee Rate (%): Default is 1%. Adjust as required.

AP Stamp Duty Fee Calculator

Purpose Stamp Duty Registration charges Fee Calculator

The tool is used to determine the following fees when registering property:

Stamp Duty: A tax on the legal recognition of a document (e.g., sale deed, gift deed).

Transfer Duty: Applicable when property ownership is transferred.

Registration Fee: Charged for recording the property details in the official records.

Leave a Reply